"Nearly 60-70 per cent cost of E-vehicle is its most common rechargeable battery (Lithium Battery), and India is fully depended on the importation of Lithium Batteries, either for cellphone, wristwatch, toys, and vehicles or any electronic, which runs on Lithium batteries".

By 2030, the government of India aims to have 100 percent Zero Emission Vehicles (Electric Vehicle) on the roads. EV sales in FY 20 was nearly 246,000 units — Cars -3,400, Three-wheeler (E-Rickshaws) – 90,000, Two-wheelers – 152,000 and Buses – 600 Units. And these numbers are expected to grow by 30 per cent till end of the 2021.

| "60-70% Cost of EVs is only its Batteries. India imports $17.18 Million valued batteries in 2020 (Jan-Oct)" |

| "60-70% Cost of EVs is only its Batteries. India imports $17.18 Million valued batteries in 2020 (Jan-Oct)" |

Nearly 60-70 per cent cost of E-vehicle is its most common rechargeable battery (Lithium Battery), and India is fully depended on the importation of Lithium Batteries, either for cellphone, wristwatch, toys, and vehicles or any electronic, which runs on Lithium batteries.

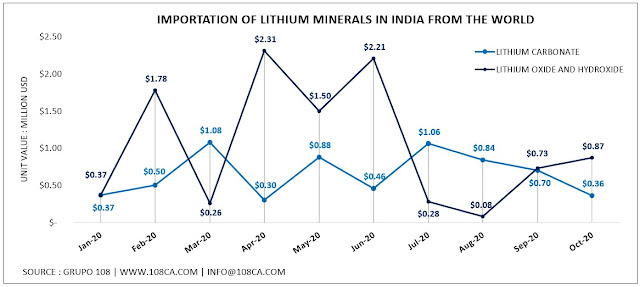

In 2020 (January-October), India imported nearly USD17.18 million valued Lithium batteries. Info-graph below shows per month importation of Lithium Batteries in India. However, the importation of Lithium Batteries dropped in March-20till July-20, but it is due to the global Pandemic lockdown.

|

| CLICK FOR ENLARGE VIEW |

| "Manikaran Power Limited, will be the first Lithium refinery in India" |

| "Manikaran Power Limited, will be the first Lithium refinery in India" |

In this pandemic, Self-reliant India campaign (Atmanirbhar Bharat Abhiyaan) is the vision of new India envisaged by the Hon'ble Prime Minister Shri Narendra Modi. Many Indian industries seeks for in house Lithium-ion Battery pack production. Last year, Manikaran Power Limited, one of the country’s largest power trading and renewable energy company will be investing over Rs 1,000 crore to set up this refinery, it will be India’s first Lithium refinery which will process Lithium ore to produce battery-grade material will be set up in Gujarat.

Lithium not only to use for manufacture of batteries but also used for manufacturing of special glass, Frits for ceramics and enamels, Cements and special adhesives, Powders for continuous casting, Industrial air conditioning, Aluminum and pharmaceuticals. India imports nearly $6.54 million valued Lithium Carbonate and $10.38 million valued Lithium Oxide and Hydroxide in 2020 (Jan-2020 to Oct 2020).

|

| CLICK FOR ENLARGE VIEW |

An overview of South American Lithium

According, US Geological Survey (USGS), there are around 80 Million tons of Lithium reserves identified globally as of 2019. Nearly 66 per cent of the world's economic Lithium deposits are found in Lithium Tringle in South America. Geographically, the “Lithium Triangle” is located on the borders where Chile, Bolivia and Argentina meet. Bounded by the Salar de Atacama, Salar de Uyuni and Salar del HumbreMuerto, the Lithium Triangle also takes in the northern ends of Chile and Argentina. As a result, these three countries dominate world Lithium supplies thanks to the tectonic forces that shaped the South American continent.

| "80 Million Tons of Lithium reserves in globally, 66% is in Lithium Trangle" |

| "80 Million Tons of Lithium reserves in globally, 66% is in Lithium Trangle" |

Chilean Lithium: The Salar de Atacama salt flat is a key resource for the nation. Since 1980, the world’s top Lithium-mining companies, SQM (Sociedad Química y Minera) and Albemarle have been mining Lithium in the Salar de Atacama. Chile’s largest salt flat, which holds nearly 9 million tons of the world’s reserves of the mineral. These two companies have rental contracts with the Corporación de Fomento de la Producción (CORFO is a Chilean governmental organization that was founded in 1939). In 2019, Chile was the second largest producer of Lithium 18000 tonnes after then Australia 42000 tonnes.

|

| CLICK FOR ENLARGE VIEW |

Argentina Lithium: Since 1997, for a long time there was only one Lithium-producing project in the country. In recent years, Argentina has experienced increased interest in Lithium mining activities. Two Lithium producers Livent and Orocobre were operating in two large mines, Salar del Hombre Muerto in Catamarca Province and Salar Olaroz in Jujuy Province of Argentina and reserves are enough for at least 75 years. The country also has the most advanced Lithium brine project in the region, which is Lithium Americas andCaucharí-Olaroz venture, and planned to go into production in 2022 and expected to produce 40,000t/y of Lithium carbonate, which would more than double Argentina’s current Lithium output of 30,500t/y. In addition, other project is in design phase of Caucharí-Olaroz with Australia’s Galaxy Resources venture in Salar de Vida. In 2019, Argentina was the fourth largest producer of Lithium production of 6,400 tonnes after then China 7500 tonnes.

|

| CLICK FOR ENLARGE VIEW |

Bolivia Lithium: The Bolivia is home to the world’s largest salt flat, the Salar de Uyuni, which contains an estimated 23 million tonnes of Lithium in brine deposits. There are two other Bolivian salt flats, the Coipasa in north and Pastos Grandes in south of Uyuni.

Until recently, Bolivia has struggled to get its Lithium out of the brines. The Uyuni’s brines contain high levels of magnesium, an impurity that’s difficult to separate from Lithium. Also, the region has relatively rainy climate this means that traditional methods for concentrating Lithium from brines is difficult, open air evaporation ponds don’t work as well as they do in the drier salt flats of Argentina and Chile, where Lithium is already being produced commercially.

The state-run company “Yacimientos del Litio Boliviano” (YBL) was created in 2017, under the Ministry of Energy of Bolivia by the Morales government with an aim to build an entire Lithium value chain from salts to batteries in Bolivia. In 2018, YLB created a joint venture with a German firm “ACI Systems”, which claimed to have new technology that could help Bolivia extract large quantities of Lithium.

Another step was taken in February 2019 — Yacimientos de Litio Bolivianos (YLB) and the Chinese company Xinjiang TBEA Group-Baocheng (YBL, 51per cent – TBEA, 49per cent) signed an agreement for the construction of the Lithium industrialization plants in the salt flats of Coipasa (Oruro) and Pastos Grandes (Potosí) that USD2,390 million in partnership for the both Salt flats. Peru Lithium: The recent discovery further north has fueled speculation that Peru too might join the Lithium party and turn the triangle into a quadrilateral. The recent discovery in the Peru Andean and Peruvian south were confirmed by 2.5 million tons of high-grade Lithium resources which is seven times higher than the deposits of Bolivia and Chile 2.5 and 124 million pounds of uranium resources at its Falchani deposit in southern Peru, but they have been found together with uranium and that marks the difference in terms of potency or the reserves of the neighbors. An opportunity for India in South America Lithium An overview of South American Lithium, shows the reserves, projects, organization, production and Lithium extraction issues. There is a lucrative opportunity for Indian Mining’s companies, Importers and for Indian industries to get the south American Lithium.

The Government of India formed; KABIL’ consortium comprising of three state-owned companies- National Aluminum Company (NALCO), Hindustan Copper (HCL) and Mineral Exploration Corp Ltd. (MECL), to acquire the most strategic mineral globally. Lithium active mineral is not only required for electric vehicles but is also used in space launchers solar panels, mobile phones and laptops and hi-tech military platforms.

Chile is the second largest Lithium producer in the world, there are currently 17 Lithium Projects in Chile where India or Indian Companies can invest and can enter in it by Bidding System, which is organized by CORFO.

On the other hand, Miners in Argentina already have created an association, named Calbafina that aims to boost the development of new projects and enable a transparent setting of prices and to create a Lithium carbonate index to track and publish the price of the battery metal on international markets. Calbafina also intends to help companies obtain financing and close deals with governments and local institutions leading to improved Lithium exploration, production and sales. Being the world’s third largest Lithium producer, the Argentine government has included 15 Lithium brine projects in its plan to boost mining exports over the next decade.

| "Miners in Argentina created an association Calbafina" |

Last year, India signed a Memorandum of Understanding (MoU) with Argentina to establish a supply link and technological development in the field of Lithium. MoU includes joint exploration, production and commercialization of mineral products. The MoU was signed between Jujuy Energía y Minería Sociedad del Estado (JEMSE), an Argentine state-owned enterprise, and the Indian joint venture company Khanij Bidesh India Ltd. (KABIL).

Bolivia is looking for the technology to extract the Lithium from its high levels of magnesium contained brines. Indian research institutes and other organization have good opportunity to work and participate in Lithium extraction technology, also can seek joint venture with YBL for extraction of Lithium active materials. Although in March 2019, both countries have signed a Memorandum of Understanding (MoU) for the development and industrial use of Lithium for the production of Lithium-ion batteries. As part of the MoU, Bolivia will support supplies of Lithium and Lithium carbonate to India, as well as joint ventures between the two countries for Lithium battery production plants in India.

| "Bolivia is looking for Lithium extraction technology" |

Peru has a long history of encouraging and supporting foreign private investment in general and in the mining sector in particular, which is and has always been paramount to the economic stability and ongoing development of the country. Canada’s Plateau Energy Metals is seeking nearly USD600 million to develop Peru’s sole Lithium project. Although, European mutual funds had shown interest in investing around USD587 million needed to help develop the Falchani deposit in the Puno region near the border with Bolivia. Plateau Energy Metals would look to raise additional funds beyond this.